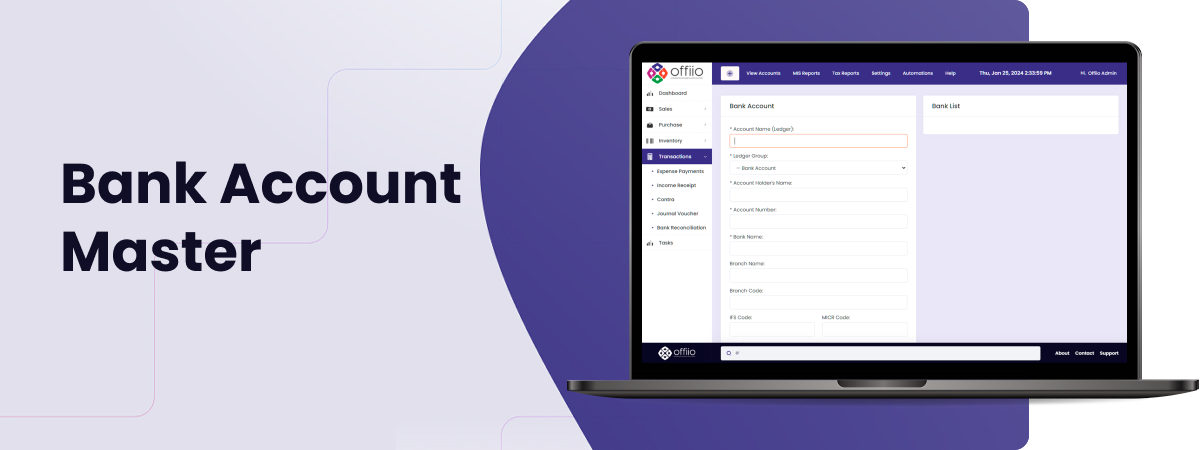

In the dynamic world of business accounting, an efficient and comprehensive software solution is crucial for managing financial transactions seamlessly. OFFIIO Business Accounting Application is a robust platform that offers a Bank Accounts Master module, providing users with the capability to add and manage multiple bank accounts, perform bank reconciliations through Excel imports, and handle all bank transactions in real-time.

Key Features of Bank Accounts Master in OFFIIO Business Accounting:

The Bank Accounts Master feature in OFFIIO is the central hub for managing all aspects of your business’s financial relationships with various banks. It allows users to set up and organize multiple bank accounts within the application, creating a systematic structure for handling transactions efficiently.

Adding Multiple Bank Accounts:

One of the standout features of OFFIIO is its ability to accommodate the diverse financial needs of businesses. Users can effortlessly add and manage multiple bank accounts, each representing a unique financial institution or account type. This flexibility is essential for businesses dealing with various currencies, jurisdictions, or financial institutions.

Managing Bank Accounts:

Once bank accounts are added, users can easily manage and monitor them within the Bank Accounts Master module. This includes updating account details, setting preferences, and organizing accounts based on specific criteria. This organized approach streamlines the financial management process, reducing the chances of errors and enhancing overall efficiency.

Bank Reconciliation using Excel Import:

Accurate bank reconciliation is a critical aspect of financial management that ensures the alignment of the company’s records with those of the bank. OFFIIO simplifies this process by offering a seamless integration with Excel, allowing users to import and reconcile bank statements effortlessly.

Excel Import Functionality:

The Excel import functionality in OFFIIO enables users to upload bank statements directly into the system. This feature saves time and minimizes the risk of manual errors that may occur during data entry. The software intelligently matches transactions, identifies discrepancies, and provides a clear overview of reconciled and unreconciled items.

Streamlined Reconciliation Process:

With OFFIIO, bank reconciliation becomes a streamlined process. The software automatically compares the transactions recorded in the system with those on the imported bank statement. Any disparities are flagged for user review, ensuring that discrepancies are promptly addressed. This real-time reconciliation process enhances accuracy and allows businesses to maintain a clear and up-to-date financial picture.

All Bank Transactions:

The Bank Accounts Master module in OFFIIO is designed to be a comprehensive repository for all bank-related transactions. It serves as a centralized hub where users can access and manage every financial interaction with their banks.

Transaction Recording:

Users can record all types of bank transactions, including deposits, withdrawals, transfers, and fees, directly within the application. This centralized approach ensures that all financial data is consistently recorded, reducing the likelihood of oversights or omissions.

Transaction History:

The software maintains a detailed transaction history for each bank account. This history is easily accessible, providing users with a chronological overview of all financial activities related to a specific account. This feature is invaluable for auditing, compliance, and historical analysis.

Real-Time Entries:

OFFIIO distinguishes itself by offering real-time entry capabilities, allowing users to record transactions as they occur. This feature ensures that financial data is always up-to-date, providing decision-makers with accurate and timely information.

Immediate Visibility:

Real-time entries mean that as soon as a financial transaction is recorded, it becomes immediately visible in the system. This instantaneous update ensures that users have access to the most current financial information, facilitating quick and informed decision-making.

Enhanced Financial Control:

The real-time entry feature in OFFIIO contributes to enhanced financial control. Businesses can monitor their financial health in real-time, identify trends, and respond promptly to any anomalies. This agility is particularly valuable in a fast-paced business environment.

Key Benefits of Bank Accounts Master in OFFIIO Business Accounting:

1. Efficient Management of Multiple Bank Accounts:

The ability to add and manage multiple bank accounts within the application offers a high level of flexibility for businesses dealing with various financial institutions, currencies, or account types. Streamlining the management of multiple accounts reduces complexity, minimizes errors, and ensures a systematic approach to financial transactions.

2. Seamless Bank Reconciliation with Excel Import:

The Excel import functionality simplifies the bank reconciliation process, allowing users to import and reconcile statements effortlessly. Reducing manual data entry not only saves time but also minimizes the risk of errors. The streamlined reconciliation process enhances accuracy and provides a clear overview of the company’s financial position.

3. Comprehensive Handling of All Bank Transactions:

The Bank Accounts Master serves as a centralized repository for all bank-related transactions, including deposits, withdrawals, transfers, and fees. Having a comprehensive overview of all financial interactions with banks ensures that businesses maintain accurate records. This centralized approach facilitates auditing, compliance, and historical analysis.

4. Real-Time Entry Capabilities:

Real-time entry allows users to record financial transactions as they occur, ensuring immediate visibility of the most current financial data. Businesses can make decisions based on up-to-the-minute information, enhancing financial control and agility. Real-time entries contribute to a proactive approach in responding to changing financial circumstances.

5. Enhanced Financial Control:

Real-time visibility and immediate access to accurate financial information contribute to enhanced financial control. Decision-makers can monitor the financial health of the business in real-time, identify trends, and respond promptly to any issues. This level of control is crucial for adapting to the dynamic nature of the business environment.

6. Time-Saving and Error Reduction:

he Excel import feature and real-time entry capabilities save time by automating data entry processes and minimizing the need for manual intervention. Time saved can be redirected towards more strategic activities, and the reduction of manual errors ensures the accuracy of financial data, contributing to the reliability of financial reports.

7. Audit Trail and Compliance:

The detailed transaction history and centralized recording of all bank transactions create a robust audit trail. This audit trail is invaluable for compliance purposes, internal and external audits, and providing a transparent record of financial activities, ensuring adherence to regulatory standards.

8. Historical Analysis and Reporting:

The comprehensive transaction history facilitates historical analysis, allowing businesses to track financial trends over time. Historical data provides valuable insights for strategic planning, forecasting, and making informed decisions based on the company’s financial performance and trends.

The Bank Accounts Master module in OFFIIO Business Accounting Application offers a comprehensive and user-friendly solution for managing multiple bank accounts, reconciling transactions through Excel imports, and recording all bank-related activities in real-time. With OFFIIO, businesses can navigate the complexities of their financial landscape with confidence, ensuring that their bank transactions are seamlessly integrated into their overall accounting framework.